WELCOME TO STARTUP CALIFORNIA!

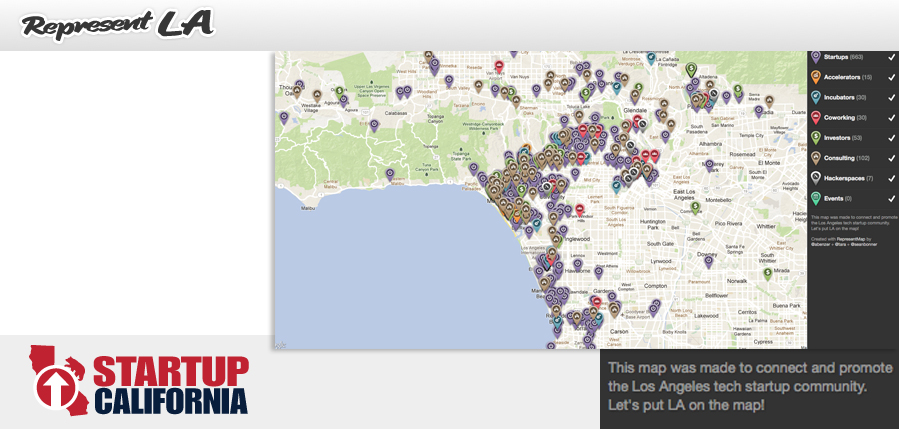

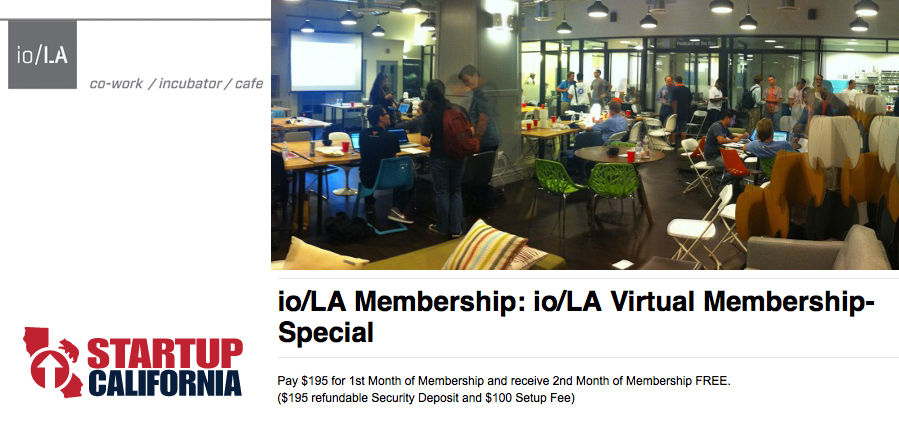

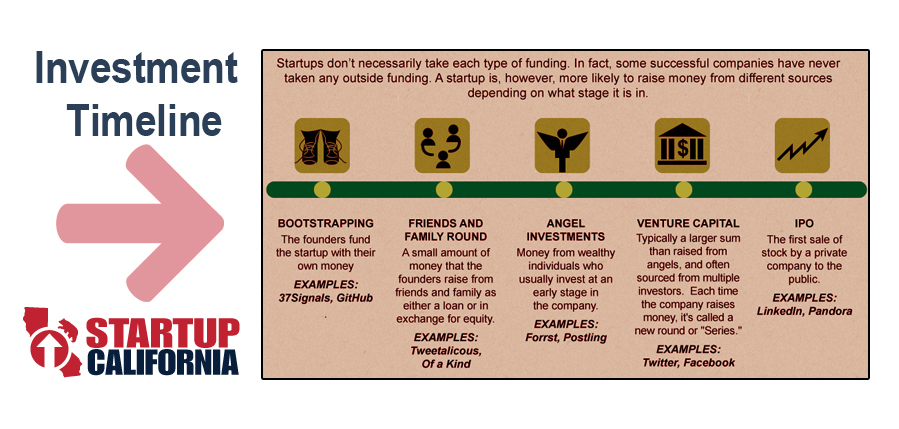

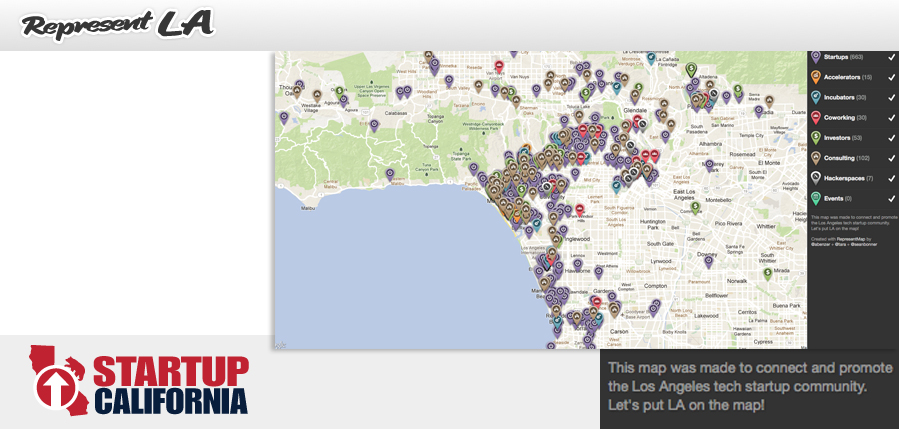

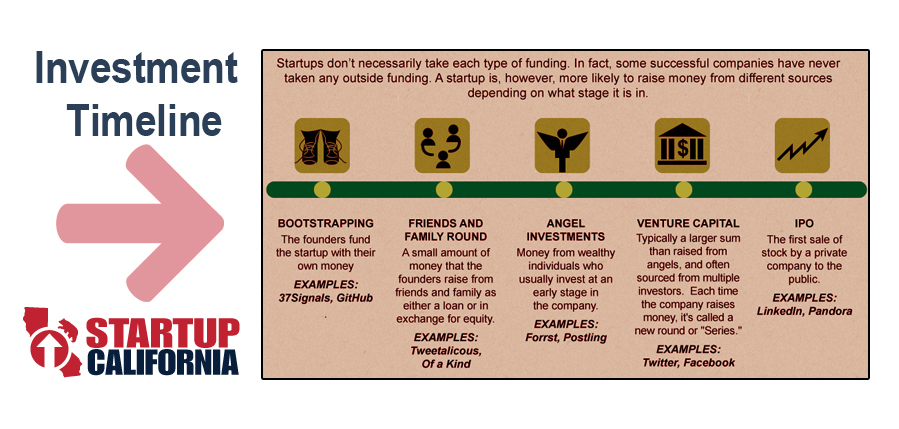

Startup California is an independent private LLC in the State of California dedicated to provided resources to help startups in California launch and grow. In addition to online links to resources to help companies in all stages of development Startup California helps organize, sponsor and support educational seminars, mixers, meetings and pitch contests designed to help companies get grow. We help founders find co-founders, mentors, board members, startup employees, advisors, distributors, sales people, patent and trademark assistance, accounting help, legal help, social media development assistance, web site development and provide numerous tools to help companies succeed at capital raising. Help startups find the right incubator, co-working space or accelerator match for them.

We collaborate with other organizations on a voluntary basis in promoting entrepreneurship.

Social